GHI Exclusive: MSH International ‘Choosing the right IPMI plan for your specific situation’

Marketing IPMI products to the expat market is evolving along with global mobility trends. IPMI companies have found that there’s a growing demand for coverage with shorter time periods.

The evolution of global mobility, now moving younger assignees, has seen the development of shorter overseas assignments and more flexible mobility packages. This also affects the IPMI products offered to expats abroad. MSH International’s VP for Sales and Marketing explains the need for Start’Expat as a solution for expats with more specific needs for coverage.

Paul Clitherow, Vice-President, Sales and Marketing, MSH International

The global trend of expatriation has seen an increase of 3% per year over the period 2013-2017, yet has not reached its peak. In 2017, the estimated number of expatriates worldwide is 57 million, making the potential market of global health insurance even larger.

Among these 57 million expatriates, we observe a variety of circumstances, from short to long-term stays abroad, from single to families, from students to snowbirds there is a wide range of health insurance needs and choosing the right IPMI plan can be a tedious and challenging task.

Travel insurance provides good emergency coverage for short-term travel, it might not be sufficient for longer periods. Whether on a backpacking trip or a short assignment abroad, travelers may need more than just emergency benefits. On the other hand, classic IPMI plans might include unnecessary benefits such as dental or maternity coverage, resulting in a high premium for the traveler. Moreover, most of these plans have a minimum enrolment period of one year, excluding all travels of 1 to 11 months.

Travel insurance coverage

A travel policy is typically meant for short term travel and will include medical emergency benefits (evacuation and hospitalization), luggage insurance (damaged or loss), trip cancellation/interruption and can be quite affordable. Some offerings will also include repatriation and AD&D (accidental death and dismemberment) benefits.

For longer periods of travel (a semester of study abroad, a mission at the company’s subsidiary overseas, etc.), travelers may require additional healthcare benefits that would bring them a total peace of mind during their stay, whether they are on the road or settled in a new city.

IPMI plans

IPMI plans offer all healthcare benefits to protect expatriates and their families abroad, from emergency benefits to routine and preventive healthcare. Most of these plans are flexible with optional benefits but they can still seem expensive for travelers who are staying abroad for a period of a few months, without planning to claim dental, vision, maternity, or preventive care benefits. Enrolment periods are usually a minimum of one year, making these plans unfit for shorter stays abroad.

Filling the gap with Start’ Expat

As we identify a gap in the marketplace between travel insurance and classic comprehensive health insurance plans, MSH INTERNATIONAL developed Start’ Expat, the in-between solution for emergency coverage during travels from short to medium term expatriations.

Start’ Expat has been designed to offer a simple and comprehensive insurance solution suited to the needs of a growing population of expatriates. The offer is available to anyone between the age of 16 and 65, planning to spend between 1 and 12 months abroad, regardless of their professional status (leisure traveler, students, expatriates, retirees etc.). Start’ Expat offers a wide range of benefits, including a generous amount of coverage under medical expenses; up to €250,000 per hospital stay and for routine medical expenses, comprehensive repatriation assistance coverage, luggage insurance, personal and tenant’s third party liability coverage abroad, lump-sum benefit in the event of death or accidental permanent disability, psychological support, etc.

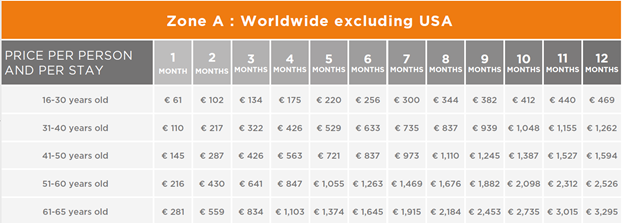

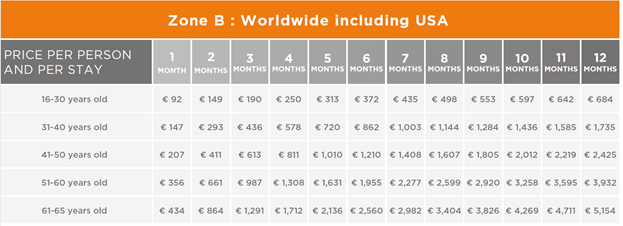

With a simple pricing based on age bands and the geographical area of residence (excluding/including USA), you can get a quote right away simply by opening our brochure.

Start’Expat also provides services that are truly essential to expatriates s when living abroad: an online members’ portal to manage your health plan from anywhere in the world, a mobile application allowing you to locate over a million healthcare professionals who are members of the MSH INTERNATIONAL network, a multicultural team speaking over 40 languages, available 24/7 in our 4 interconnected Customer Care Centers in Calgary, Paris, Dubai and Shanghai.

Learn more about Start’Expat in their full press release here.

Leave a Comment

* Fields marked with this asterisk are mandatory.